INSURANCE COST AND availability has been a top trucking industry concern for a number of years. In fact, in the 2005 inaugural Top Industry Issues Survey conducted by the American Transportation Research Institute (ATRI), the cost of insurance was ranked third overall. More recently, ATRI’s annual survey saw insurance cost/availability rise again into the top 10, ranking 5th overall in 2020 and 9th overall in 2021.

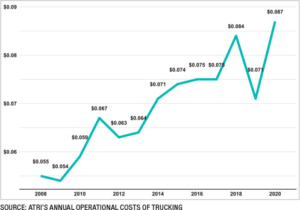

Volatile and increasing insurance premiums have created a very challenging operating environment for fleets. ATRI’s annual An Analysis of the Operational Costs of Trucking report found that insurance premium costs per mile increased overall by 47 percent over the last 10 years, from $0.059 to $0.087.

The recent rise in nuclear verdicts is certainly one factor in the continued escalation of insurance premiums. ATRI’s study examining the growth in nuclear verdicts against the industry found a nearly 1000 percent increase in the average verdict size over $1 million between 2010 and 2018.

In recognition of these challenges, ATRI’s Research Advisory Committee ranked as a top research priority an analysis examining trucking industry impacts from the rising costs of insurance. ATRI recently published that analysis, which utilized detailed financial and insurance data from dozens of motor carriers and commercial insurers. The report assessed immediate and longer-term impacts that rising insurance costs have had on carriers’ financial condition, safety technology investments and crash outcomes, as well as strategies used by carriers to manage escalating insurance costs.

Among the key findings, fleets are pursuing a number of strategies, including raising deductibles or Self-Insured Retention levels, and decreasing investment in other cost centers, all in an attempt to mitigate the rising cost of insurance premiums. However, even with this increased liability exposure, out-of-pocket incident costs and carrier crash involvement remained stable or even decreased among a majority of respondents in ATRI’s study.

Despite reductions in insurance coverage, rising deductibles and improved safety, almost all motor carrier participants experienced substantial increases in insurance costs from 2018 to 2020. Premiums increased across all fleet sizes and sectors, with small fleets paying more than three times as much as very large fleets on a per-mile basis. One-third of respondents reported cutting wages or bonuses due to rising insurance costs, and 22 percent cut investments in equipment and technology – potentially creating future safety and workforce concerns. However, in the short-term, crash data confirms that carriers that raised deductibles or reduced insurance coverage were generally incentivized to reduce crashes in the subsequent year.

A copy of the full report is available from ATRI’s website at www.TruckingResearch.org. In addition to providing more granular findings across fleet size and sector, the study describes a process for calculating the “Total Cost of Risk” in order to evaluate the full scale and impact of rising insurance costs on a carrier’s long-term safety and financial viability, including safety investments in drivers, programs and technologies.